NHIF is a government corporation of Kenya that is responsible for health insurance to Kenyan citizens. It’s an abbreviation for National Health Insurance Fund. NHIF is run and conducted by the government. Its main aim is to offer affordable healthcare services to every Kenyan. The insurance cover is paid 500 KES monthly or 6000 KES per annum for self employed. Employers are set to pay 1700 KES per month for employee’s earning 100,000 and above. After registering as a new member, you need to pay for 3 months, a total amount of 1500, and you have to wait for 2 months to mature so you can start benefiting from it. Your NHIF is usually paid up until the fourth month after registration.

The main offices of NHIF are in Nairobi. The best thing is, to access NHIF, you don’t need to go to Nairobi. NHIF has branch offices in every county. NHIF is also accessible through their USSD by dialing *155# or their NHIF portal online.

NHIF USSD

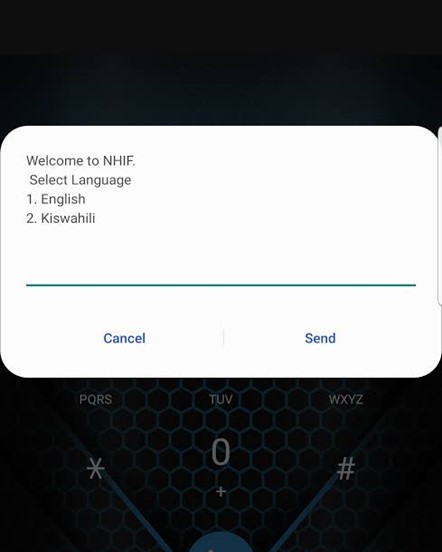

When using the NHIF USSD, after dialing *155#, you will have a message like the first image.

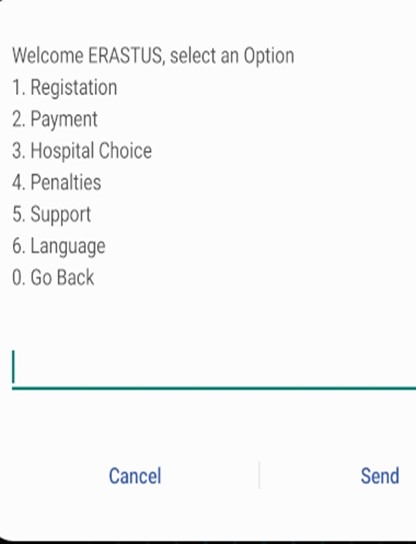

After choosing your preferred and convenient language, the menu is like the second image. From there you can choose which option to do. If you are a new member, you can register to NHIF by clicking 1. You can also choose a hospital through that same USSD in option 3. You can check if your NHIF account is fully paid or has arrears by clicking option 2. If you skipped a month without paying NHIF and you are penalized, you could check through option 4. NHIF account support and questions regarding it, we have option 5. And to exit the NHIF menu click 0.

NHIF ONLINE PORTAL

You can also access NHIF services by logging in to their online portal. Their official link is https://nhifcare.co.ke/Otp.html. To login, you only need your ID number, just like the USSD. The menu is almost the same as the USSD, just this being a website. After inputting your ID number, they send a one-time code that is valid for one day. You enter the code and login into your NHIF self-service portal. You select the options you want to check.

NHIF pay bill number

NHIF has a billing option with M-PESA since it’s the most convenient and most used by Kenyans. To pay NHIF successfully, you need to follow these steps.

- Open your sim toolkit and open M-PESA

- Select lipa na M-PESA

- Choose to enter the business number and enter 200222 as the business number or pay bill number.

- Press enter account number and input your National ID number.

- Enter your preferred amount to pay NHIF

- Input your M-PESA pin and send the transaction

M-PESA will show pop up asking you to confirm the payment of ‘the amount you chose, for example, 500’ to NHIF for an ID number; they will show your ID number as you had input it.

M-PESA will show pop up asking you to confirm the payment of ‘the amount you chose, for example, ‘Ksh. 500’ to NHIF for an ‘ID number’; they will show your ID number as you had input it.

To check if your contributions were received, you can use the USSD or send a new text to 21101 with ID, then space and type your ID number e.g “ID 12312301”. NHIF will send you a message with all the information about your NHIF status. The message will have your member number, your last contributions, the dependents in the NHIF card, your ID number, and the year you were born.

NHIF Penalties

You must pay NHIF every month before the 9th; being late than the specified date, they include a penalty of 250 KES every month you don’t pay.

If you pay your penalty today, you will not start using your NHIF card instantly. You will have to wait for 60 days or two months precisely to start enjoying the cover again.

How to pay for NHIF penalties

Go to your M-PESA menu

Select lipa na M-PESA

Enter pay bill number, 200222

Account number enter your ID number followed by letter “Y”

Enter the amount you had defaulted, then confirm.

NB

if you don’t put the letter y at the end of your ID number NHIF will not be able to lift up the defaulted penalty. If your ID is 12345678, you add y only when paying for a penalty, so input 12345678y.

If you are a self employed and haven’t been contributing for one year or more, NHIF deactivates your account. To activate your account back, you’ll need to pay 1500 KES and wait for two months to enjoy its cover.

Applying for NHIF is absolutely free. No fee is required. Only monthly contributions are made.

NHIF can be used in any hospital accredited with NHIF for inpatient services. However, for outpatient services, only the hospital on your card can help.

NHIF has cover limits. For low-cost governmental hospitals, the maximum spend per day is 1200 KES, and in private high-cost hospitals is 4000 KES per day, these charges apply to inpatient services only.

NHIF does not cover 18+ individuals. They are required to have their own nhif card.

MORE RELATED POSTS

- TSC Payslip for Teachers: Registering, Logging In, and Getting Payslip at the…

- 2021/2022 TSC Wealth Declaration Procedure for Teachers and Administrators

- Understanding your Teachers Service Commission (TSC) Online Payslip: Abbreviations

- TSC Teachers Cry as Another Union other than KEWOTA Invades Payslips

- TSC Circular on Online Declaration of 2019 – 2021 Income, Assets & Liabilities (DIALs)

- How Teachers Can Save Money even with a ‘Meager Payslip.’

- Sossion Forms New Teachers Trade Union as union lures Teachers to Join

- Why KUPPET Teachers Are Not Happy Regarding BBF Contribution

- Here Are the Revised TSC T-Pay Guidelines for All Third Party Deductions

- Teachers without unions Should Expect TSC to Deduct Agency Fees

- Here Are the Evidences Intern Teachers Will Be Required To Submit On the Day ofinterviews

- TSC to Return Teachers Back to KNUT and Resume Union Deductions

- TSC Releases New Guidelines on Managing Check off Facility Effective The 1st Of…

- KNEC requirement for Registration of New Examination Centres

- AON Minet Set Deadline for Uploading Dependants Documents on The 10th Of April…

- HELB Reports 50% Increase in Loan Defaulters as Economy Dwindles

- Teachers to lose 2% of Basic pay to the pension scheme in January

- Teachers Blame TSC for Failing to Remit NHIF Deductions

- TSC Interviews: Preparation, Documents, and How to Score All the Marks

- Download 2020/2021 Schemes of Work for Free